GST Calculator for Small Businesses

Calculate Your GST Liability

Enter your business sales and expenses to determine how much GST you owe or are due back.

GST Calculation Result

Due Date: October 28

How it works: GST is 10% of sales. The ATO calculates this as 1/11th of total sales including GST. You can claim back 1/11th of business expenses with GST included.

Example: $120,000 sales with GST ($12,000) minus $50,000 expenses with GST ($5,000) = $7,000 GST owed to ATO.

If you run a small business in Australia and your turnover hits $75,000 a year, you must file GST. It’s not optional. Skip it, and you’ll face penalties, interest, or worse - your business could be flagged by the ATO. But filing GST doesn’t have to be confusing. This guide walks you through exactly what to do, when to do it, and how to avoid the most common mistakes.

What is GST and who needs to file it?

Goods and Services Tax (GST) is a 10% tax on most goods and services sold in Australia. If your business earns more than $75,000 in a year (or $150,000 for non-profit organisations), you’re required to register for GST. Once registered, you collect GST from customers and pay it to the ATO - but you can also claim back GST you paid on business expenses.

It’s not just big companies. Freelancers, tradespeople, online sellers, and even home-based businesses need to file if they hit the threshold. If you’re unsure, check your turnover over the last four quarters. If you’re close to $75,000, it’s better to register early than risk being caught off guard.

Step 1: Register for GST

You can’t file GST returns unless you’re registered. Go to the Australian Taxation Office (ATO) website and use their online business registration tool. You’ll need:

- Your ABN (Australian Business Number)

- Your business name and address

- Details of your business activities

- Your bank account details for refunds or payments

Registration usually takes less than 10 minutes. Once done, the ATO will email you a confirmation and your GST account number. Keep this handy - you’ll need it every time you file.

Step 2: Choose your reporting period

Most small businesses report GST quarterly. But you can choose monthly if your turnover is over $20 million, or annually if you’re a small business with under $10 million turnover and meet certain conditions.

Quarterly is the most common. That means you file four times a year: by the 28th day after the end of each quarter:

- Quarter 1 (July-September): Due October 28

- Quarter 2 (October-December): Due January 28

- Quarter 3 (January-March): Due April 28

- Quarter 4 (April-June): Due July 28

If you use a tax agent, they can apply for extended deadlines - usually up to three weeks later. But if you’re filing yourself, don’t wait. Missing the deadline triggers automatic penalties.

Step 3: Gather your records

You need three key sets of data to file accurately:

- Sales invoices: All sales you made, including GST charged.

- Expense receipts: Business purchases where you paid GST (like tools, software, fuel, office supplies).

- Bank statements: To cross-check what you recorded against actual deposits and payments.

Use accounting software like Xero, QuickBooks, or even Excel - but make sure you track every transaction. The ATO doesn’t care if you’re using a shoebox full of receipts. They care if your numbers add up.

Step 4: Log in to the ATO Business Portal

Go to ato.gov.au and sign in to your Business Portal. If you don’t have an account, link your ABN to your myGov account first. Once logged in:

- Select Business > GST

- Click lodge a return

- Choose your reporting period

The portal will auto-fill some data if you’ve connected your accounting software. But don’t rely on that. Always double-check every number.

Step 5: Fill in your GST return

Your GST return has four main sections:

- G1: Total sales - All sales including GST. Don’t forget online sales, cash payments, or sales to other businesses.

- G2: GST on sales - This is 1/11th of G1. The system calculates this automatically, but verify it.

- G3: GST on purchases - Total GST you paid on business expenses. Only claim what you used for business.

- G4: Net GST amount - This is G2 minus G3. If it’s positive, you owe money. If it’s negative, you get a refund.

Example: You made $55,000 in sales (including GST). That’s $5,000 GST collected. You spent $20,000 on business supplies with GST included. That’s $1,818 GST paid. Your net GST is $5,000 - $1,818 = $3,182. That’s what you pay to the ATO.

Step 6: Submit and pay (or claim your refund)

Once you’ve reviewed everything, click Submit. You’ll get an instant confirmation email. If you owe money:

- Pay by the due date using BPAY, direct debit, or credit card (fees apply).

- Set up a payment plan if you can’t pay in full - but do it before the deadline.

If you’re due a refund, it usually hits your bank account within 14 days. Keep an eye on your bank - refunds don’t always come with a notification.

Common mistakes and how to avoid them

Here’s what most people get wrong:

- Forgetting cash sales - If you took $100 cash for a service, that’s $9.09 GST you need to report.

- Claiming personal expenses - You can’t claim GST on your coffee or personal phone bill.

- Mixing GST and non-GST items - Some services (like education or healthcare) are GST-free. Don’t add GST to them.

- Waiting until the last minute - The portal gets jammed on the 27th. File on the 25th.

Keep a simple spreadsheet with your monthly sales and expenses. Update it every Friday. That way, filing becomes a 20-minute task instead of a 4-hour panic.

What happens if you miss a deadline?

The ATO doesn’t wait. If you’re late:

- First offense: $222 penalty

- Each additional month late: $1,110

- Interest charged daily on unpaid amounts

Repeated failures can lead to your ABN being suspended. That means you can’t invoice clients, open bank accounts, or claim deductions. It’s not worth the risk.

If you missed a deadline, file immediately. Then call the ATO. They often waive penalties for first-time offenders who act fast.

When to use a tax agent

You don’t need one - but many small business owners find them helpful. A registered tax agent can:

- File your return for you

- Advise on what expenses you can claim

- Help you set up bookkeeping systems

- Extend your deadlines automatically

Fees range from $150 to $500 per return, depending on complexity. If you’re spending more than 5 hours a quarter on GST, it’s cheaper to hire help.

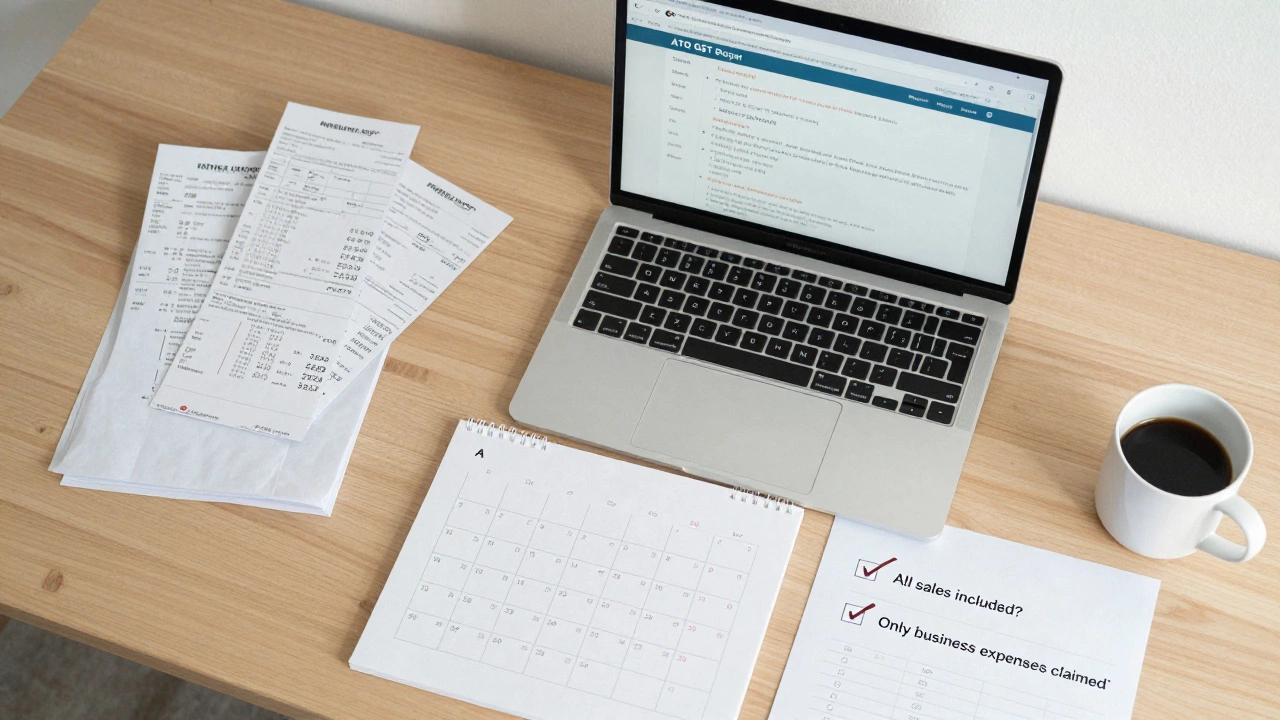

Final checklist before you hit submit

Before you file, run through this quick list:

- Did I include all sales, even cash and online?

- Did I only claim GST on business-related purchases?

- Is my ABN and GST registration number correct?

- Did I check my bank statements against my records?

- Did I file before the due date?

If you answered yes to all, you’re good to go.

Do I need to file GST if I’m not making a profit?

Yes. GST is about your sales, not your profit. Even if your business lost money, if your turnover is over $75,000, you must file. You can still claim back GST on your expenses, which may reduce what you owe or give you a refund.

Can I file GST monthly instead of quarterly?

Yes, if your turnover is over $20 million a year. Most small businesses stick with quarterly because it’s simpler and gives you more time to gather records. Monthly reporting is usually only worth it if you’re getting frequent refunds or managing large cash flow.

What if I made a mistake on my GST return?

You can amend it through the ATO Business Portal. Go to your lodged return, select ‘Amend’, and make the correction. Do this as soon as you spot the error. If you underpaid, you’ll owe interest. If you overpaid, you’ll get a refund. The ATO allows amendments up to four years back.

Do I need to keep physical receipts for GST claims?

No. The ATO accepts digital copies - emails, scanned receipts, or records from accounting software. But you must keep them for five years. If you’re audited, you need to prove your claims. A photo of a receipt on your phone is fine - as long as it’s legible and includes the date, vendor, and GST amount.

Can I claim GST on my car if I use it for business?

Yes, but only for the business portion. If you drive 60% for work, you can claim 60% of the GST paid on fuel, servicing, insurance, and registration. You need to keep a logbook for 12 weeks every five years to prove your usage. Don’t guess - the ATO will challenge it.