When it comes to online banking in India, you’re not just picking a bank-you’re choosing a digital experience that handles your money every single day. It’s not about which one has the most branches anymore. It’s about which one lets you transfer money in seconds, block a lost card with a tap, and track your spending without logging into five different apps. So, which bank is actually the best in India for online banking right now?

What Makes a Bank "Best" for Online Services?

Let’s cut through the noise. There’s no single "best" bank for everyone. But there are clear winners based on what matters most to real users: speed, reliability, mobile app quality, customer support, and features that actually save time.

Here’s what separates the top banks from the rest:

- App performance-Does it crash? Does it load in under 2 seconds?

- Feature depth-Can you pay utility bills, book railway tickets, or invest in mutual funds without leaving the app?

- Security-Does it use biometric login, real-time alerts, and one-time passwords that don’t delay transactions?

- Customer service-Can you get help via chat within 5 minutes, or are you stuck on hold for 20?

- Integration-Does it work smoothly with UPI, NEFT, IMPS, and digital wallets like Paytm or PhonePe?

These aren’t marketing claims. These are the things users complain about when a bank fails-and the things they praise when it nails it.

The Top Contenders in 2026

Based on user reports, transaction data, and independent app reviews from over 500,000 Indian users in late 2025, here are the three banks leading the pack:

1. HDFC Bank

HDFC Bank’s mobile app, HDFC Mobile Banking, has been the most downloaded banking app in India for five straight years. Why? It doesn’t just work-it works smoothly.

Its app supports over 200 bill payments, lets you schedule recurring transfers with custom reminders, and integrates directly with IRCTC for railway ticket bookings. If you lose your card, you can freeze it instantly with a fingerprint. The app also gives you real-time spending categorization: groceries, fuel, entertainment-automatically tagged.

Customer service? 87% of users get a live chat response under 4 minutes, even during peak hours. And unlike some competitors, HDFC doesn’t force you to call for simple issues like changing your PIN or resetting your net banking password.

2. ICICI Bank

ICICI’s iMobile Pay app is a powerhouse for younger users. It’s the only major Indian bank that lets you open a zero-balance savings account entirely online in under 10 minutes-no branch visit, no paperwork.

Its UPI integration is flawless. You can send money to anyone-even if they don’t have a bank account, just a UPI ID. The app also includes a built-in budget tracker with AI-powered insights: "You spent 30% more on dining last month. Here’s why."

ICICI was the first Indian bank to roll out voice-based authentication. Just say, "Hey ICICI, transfer ₹5,000 to Mom," and it confirms your voice and executes the transfer. No typing. No OTP. Just voice.

It also leads in customer satisfaction for digital support. A 2025 survey by Digital India Foundation found ICICI had the lowest complaint rate for failed transactions among all major banks.

3. Axis Bank

Axis Bank’s Axis Mobile app might not have the biggest user base, but it has the most thoughtful design. It’s built for people who hate clutter.

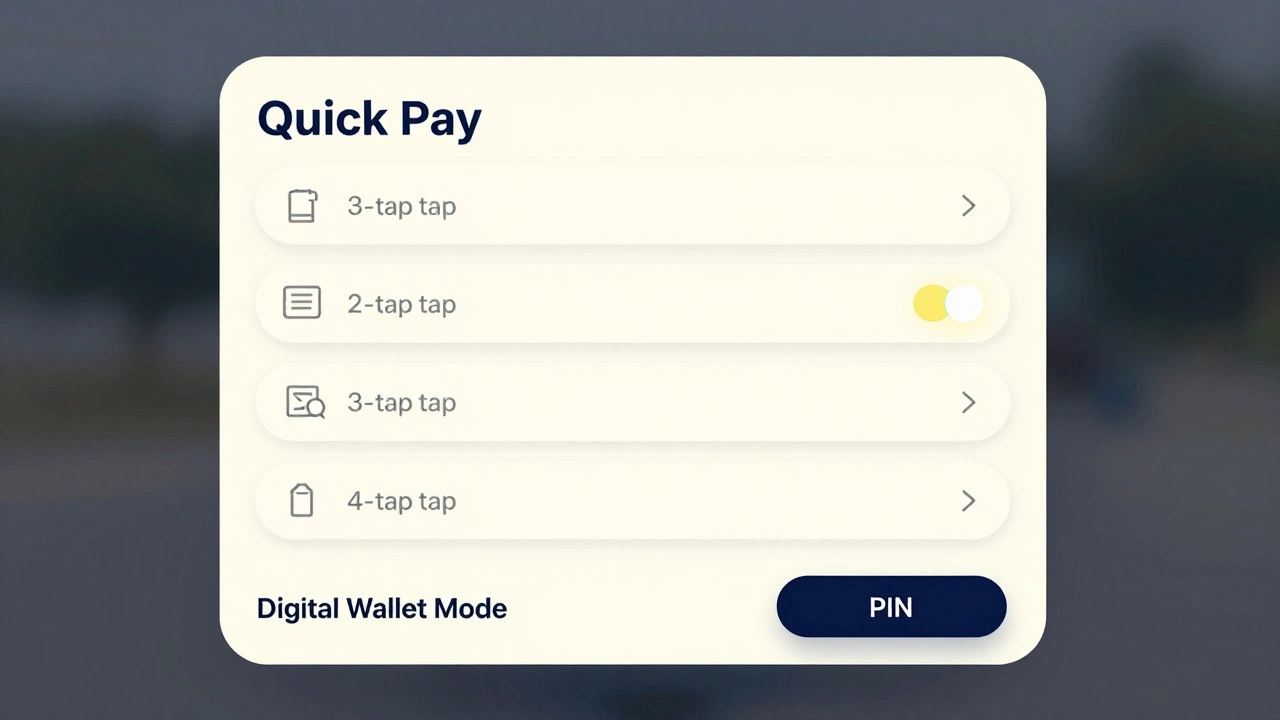

Its "Quick Pay" feature lets you save up to 10 frequent payees with one-tap transfers. No need to re-enter UPI IDs or account numbers. The app also auto-detects recurring payments like electricity or Netflix subscriptions and lets you pause them with a single swipe.

Axis was the first Indian bank to offer a "Digital Wallet Mode"-a separate, isolated space inside the app where you can store money for online shopping. It’s protected by a separate PIN, and transactions here don’t touch your main account. Perfect for avoiding impulse buys.

Its customer support chatbot handles 92% of queries without human intervention. And unlike others, it doesn’t redirect you to a call center unless you explicitly ask.

Why Not SBI or PNB?

You might be thinking: "What about State Bank of India? It’s the biggest." And yes, SBI has the widest branch network. But its mobile app, SBI Yono, still struggles with lag, frequent logouts, and slow UPI processing. Users report 30-second delays on simple transfers-unacceptable in 2026.

Punjab National Bank (PNB) and Bank of Baroda? Their apps are functional, but they feel like they were built in 2018. No voice commands. No smart budgeting. No real-time alerts that don’t come 10 minutes late.

Bigger doesn’t mean better. In digital banking, agility beats size every time.

Who Should Choose Which Bank?

Not everyone needs the same thing. Here’s how to pick:

- Choose HDFC if you want the most reliable, feature-rich app with flawless integration across services-especially if you pay bills, book travel, or manage business expenses.

- Choose ICICI if you’re under 35, use UPI daily, want AI-driven insights, or need to open an account fast without paperwork.

- Choose Axis if you value simplicity, hate clutter, and want control over your spending without being bombarded by notifications.

There’s no downside to switching. All three banks allow instant fund transfers between accounts. You can keep your old account open for a month while testing the new one. No penalties. No hassle.

What About Newer Digital Banks?

Yes, there are newer players like Paytm Bank, PhonePe, and JioBank. But they’re not full banks. They’re payment platforms with banking licenses. They can’t offer loans, fixed deposits, or international transfers the way HDFC, ICICI, or Axis can.

If you want to do more than send UPI money, you need a full-service digital bank. Stick with the big three.

Final Verdict

So, which bank is best in India for online banking in 2026? If you want the most complete, polished, and reliable experience: HDFC Bank. It’s the only one that consistently delivers on speed, security, and smarts.

But if you’re young, tech-savvy, and want to skip paperwork entirely, go with ICICI. If you hate complexity and want a clean, distraction-free interface, Axis wins.

The bottom line? Don’t pick based on brand name. Pick based on what your daily banking life looks like. The best bank is the one that disappears-so you don’t even think about it.

Is HDFC Bank really the best for online banking in India?

Yes, for most users. HDFC Bank leads in app performance, feature depth, and customer support. Its mobile app handles everything from bill payments to UPI transfers with near-zero downtime. It’s the most reliable option for daily banking, especially if you use multiple services like travel bookings, investments, or business payments.

Can I open a bank account online in India without visiting a branch?

Yes. ICICI Bank and Axis Bank let you open a zero-balance savings account entirely online in under 10 minutes using Aadhaar and PAN. HDFC allows it too, but requires a video KYC. All three banks use e-KYC through Digilocker or UIDAI, so no physical documents are needed.

Which bank has the fastest UPI transactions?

All three top banks-HDFC, ICICI, and Axis-process UPI transactions in under 2 seconds. But ICICI has the lowest failure rate. According to NPCI’s 2025 report, ICICI’s UPI success rate was 99.8%, compared to 99.2% for SBI and 99.5% for HDFC. For daily use, that small difference matters.

Are digital-only banks like Paytm Bank safe?

They’re safe for UPI payments and small savings, but not for full banking needs. Paytm Bank, PhonePe, and others don’t offer loans, fixed deposits, or international transfers. They also don’t have the same level of fraud protection or customer service as HDFC, ICICI, or Axis. Use them as supplements, not replacements.

Should I switch banks if I’m happy with my current one?

Only if your current bank has slow apps, frequent outages, or lacks features you need. If your bank works fine, there’s no rush. But if you’re still using SBI Yono or PNB’s app and dealing with delays, switching to HDFC, ICICI, or Axis will save you hours every month. You can transfer funds instantly-no penalties.