Capital One 360 Rewards: What You Actually Get and How It Compares

When you hear Capital One 360 rewards, a no-fee, high-interest savings product from a major U.S. bank that operates entirely online. Also known as Capital One 360 Savings, it's designed for people who want to earn more on their cash without jumping through hoops. Unlike traditional banks, Capital One 360 doesn’t charge monthly fees, doesn’t require a minimum balance, and pays interest daily—compounded monthly. That’s the basics. But here’s what most people miss: the real reward isn’t just the interest rate. It’s the simplicity.

That simplicity connects directly to other key financial tools you might already use. For example, if you’ve looked into high-yield savings, accounts that pay significantly more interest than standard savings accounts, often offered by online-only banks, you know they’re popular because they’re low-risk and liquid. Capital One 360 fits right in. But unlike some competitors, it doesn’t hide behind flashy bonuses or confusing terms. The rate is transparent, the app is clean, and withdrawals are instant. It’s not a get-rich-quick scheme. It’s a steady, reliable place to park money you might need in the next few months.

And safety? That’s non-negotiable. Your money in a Capital One 360 account is protected by FDIC insurance, a U.S. government program that guarantees up to $250,000 per depositor, per insured bank. That’s the same protection you’d get from Chase or Bank of America—but without the branch fees or minimum balance traps. Online banking has come a long way. Today, security isn’t just about encryption; it’s about trust. Capital One has been running this model for over a decade, and their systems are built for scale and stability.

Now, you might wonder: is this better than a fixed deposit in India? Or a PPF account? Not exactly. Capital One 360 is for people who need U.S.-based banking, often expats, NRIs with U.S. income, or anyone managing finances across borders. If you’re in India and looking for safe, tax-efficient growth, PPF or liquid funds might make more sense. But if you’ve got dollars sitting idle, and you want them to work without risk or hassle, Capital One 360 rewards deliver exactly that.

You’ll find posts here that dig into how safe online savings accounts really are, how FDIC insurance works in practice, and how today’s best savings rates compare across banks. Some of these accounts pay more than others, but few match the combination of ease, reliability, and transparency that Capital One 360 offers. Whether you’re saving for a trip, building an emergency fund, or just trying to outpace inflation, the real question isn’t whether you can earn more elsewhere—it’s whether you can do it without stress.

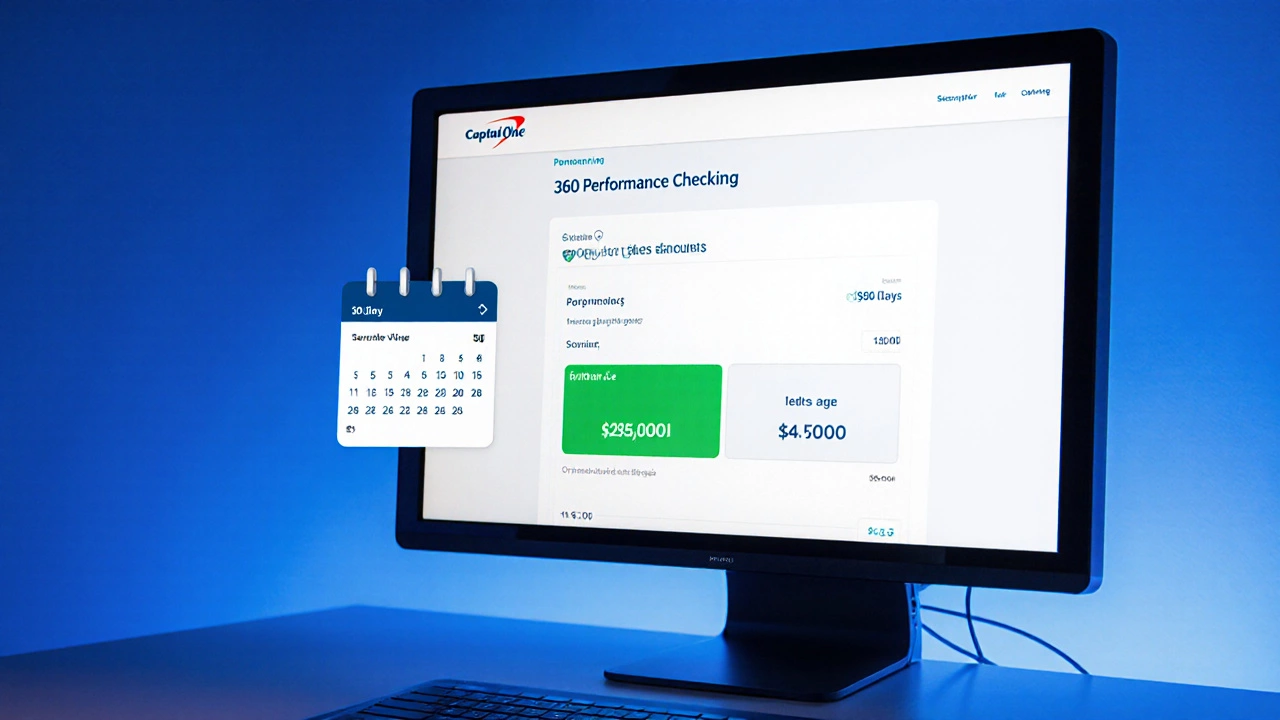

What Is the $1500 Bonus for Capital One 360 Performance?

The $1500 bonus from Capital One 360 Performance Checking requires depositing $25,000 and keeping it for 180 days. It's a rare, high-bar offer for people with significant savings-not a typical sign-up bonus.

View more