Stock Sale Tax Calculator

Calculate the true cost of selling your stocks to cover cash needs. Input your stock details and see how taxes impact your decision.

You’re staring at your brokerage account. The market’s up, your stock’s sitting at a nice gain, and then it hits you-you need cash. Maybe it’s an unexpected bill, a car repair, or a family emergency. The question isn’t just should I sell stock if I need cash? It’s: is this the right move, right now?

Stop. Breathe. Don’t Panic-Sell.

Selling stock because you need cash isn’t wrong. But doing it on impulse? That’s how people lose money. The biggest mistake isn’t selling-it’s selling for the wrong reason. If you’re selling because the market dropped and you’re scared, that’s emotional. If you’re selling because you need $5,000 for a medical bill and you’ve got no other options? That’s practical.

Here’s the truth: stocks are meant to grow over time. Selling them to cover short-term needs can hurt your long-term wealth. But life doesn’t wait for perfect timing. So how do you decide?

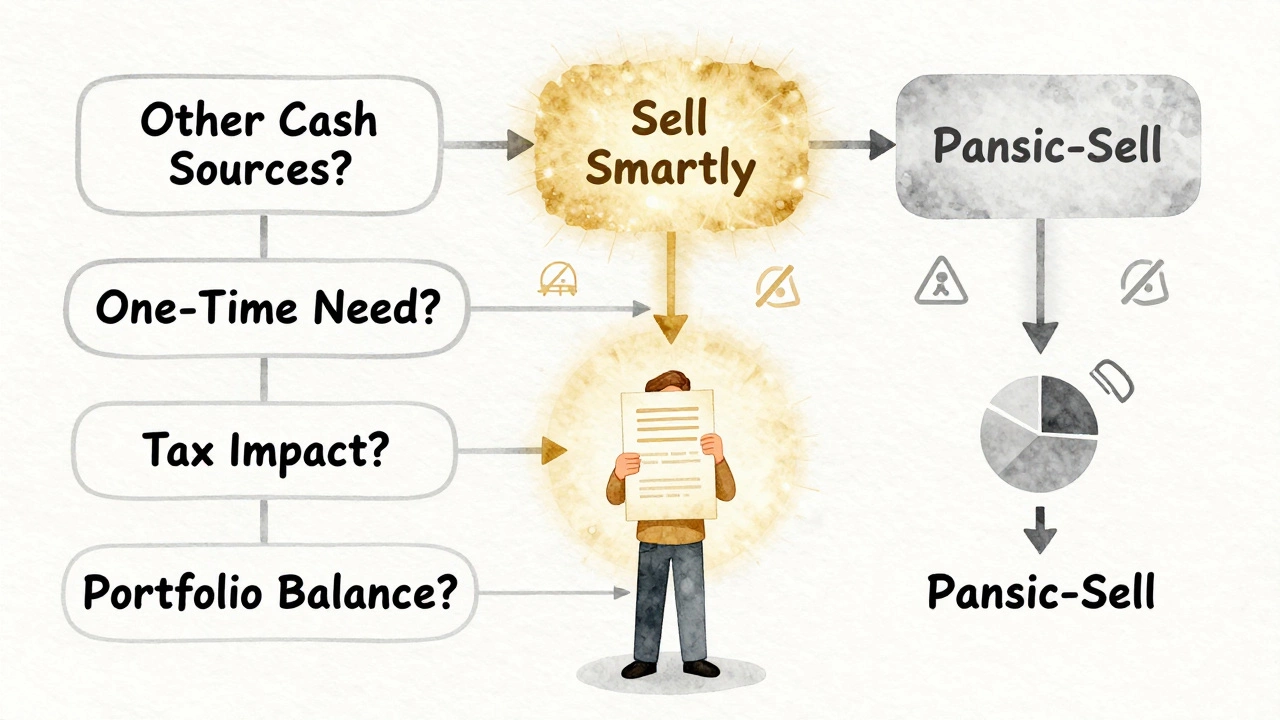

Ask Yourself These Four Questions

Before you click ‘Sell,’ run through this checklist. It takes five minutes. It could save you thousands.

- Do I have other sources of cash? Do you have a savings account? A line of credit? Even $2,000 in a high-interest account is better than selling a stock at a loss. If you’ve got cash reserves, use them first.

- Is this a one-time need or a recurring problem? If you’re constantly dipping into stocks to pay bills, you’ve got a budget issue-not a stock issue. Fix the spending. Don’t just keep selling assets.

- What’s the tax impact? If you’ve held the stock for less than a year, you’ll pay short-term capital gains tax-often at your regular income rate. If you’ve held it over a year, you get the lower long-term rate. Selling now could mean paying 15% to 30% extra in taxes, depending on your income. That’s a big hit.

- Will selling this stock hurt my portfolio balance? If this stock is 30% of your portfolio, selling it could throw off your diversification. You might end up overexposed to one sector or too conservative after the sale. Rebalancing after a big sale takes time and planning.

What If I Have No Other Cash?

Let’s say you’ve maxed out your savings, tapped out your credit card, and you’re still $3,000 short. You have no choice but to sell. That’s okay. But don’t just sell the first stock you see.

Here’s how to do it smartly:

- Sell the worst performer first. If one of your stocks is down 20% and another is up 40%, sell the loser. You’ll lock in the loss, which you can use to offset other capital gains later. That’s called tax-loss harvesting. It’s a legal way to reduce your tax bill.

- Don’t sell your best performers unless you have to. If a stock has doubled in value and still has strong fundamentals, it’s likely to keep growing. Selling it now means giving up future gains. Keep the winners.

- Use limit orders, not market orders. A market order sells at whatever price it can get. A limit order lets you set the minimum price you’ll accept. If the stock dips suddenly, you won’t get stuck with a bad price.

What About Dividends? Can I Use Those Instead?

If you own dividend-paying stocks, you might not need to sell at all. Many investors forget they can live off dividends. If your portfolio pays $1,500 a year in dividends and you need $1,000 this month, you can take the dividend and leave your shares alone.

Dividends are cash in your pocket without touching your principal. That’s the holy grail of investing. But here’s the catch: not all stocks pay dividends. And even those that do don’t always pay monthly. Most pay quarterly. So if you need cash in February and the next dividend is in May, you still need a plan.

One smart move: keep a small cash buffer-say, 3 to 6 months of living expenses-in a high-yield savings account. Fund it with dividends. That way, when you need cash, you’re not touching your investments.

What Happens After I Sell?

Selling is only half the battle. What you do next matters just as much.

After you sell, ask yourself: Do I need to buy back in? If you sold because you were scared, you might be tempted to buy back when the market recovers. But timing the market is a trap. Most people buy high and sell low without realizing it.

If you sold a stock because you needed cash, don’t rush to replace it. Wait. Reassess. Is the company still strong? Has its outlook changed? If yes, you can buy back later-but only when you’re ready, not when you’re anxious.

And if you sold because you needed cash for something that wasn’t an emergency? Like a vacation or a new phone? That’s a red flag. You’re using your future money to fund today’s wants. That’s not investing. That’s spending.

Real-Life Example: Sarah’s Story

Sarah, 42, lives in Sydney. She had $20,000 in tech stocks she bought five years ago. They’d grown to $38,000. Then her boiler broke. The repair cost $8,500. Her savings had been wiped out during the pandemic.

She didn’t sell her top-performing stock-Apple. Instead, she sold her smaller holding in a biotech firm that had dropped 15% in the last six months. She used tax-loss harvesting to offset $3,000 in gains from other sales. She paid only $800 in tax instead of $2,500.

She kept her Apple shares. They’re now worth $62,000.

She didn’t sell because she needed cash. She sold because she planned it.

When Selling Is the Right Move

There are times when selling stock to get cash is the smartest thing you can do:

- You need money for a life-changing expense: medical treatment, home repair, education.

- You’re retiring and need steady income-selling a small portion each year is better than relying on volatile market swings.

- You’ve held the stock too long and it’s become a distraction. You’re watching it daily, stressing over every dip. That’s not investing. That’s gambling.

- You’ve found a better investment opportunity and you need to free up capital. But only if the new opportunity is truly better-not just flashier.

When Selling Is a Mistake

Don’t sell if:

- You’re trying to avoid a short-term market dip. Markets recover. People who panic-sell often miss the rebound.

- You’re selling to fund lifestyle inflation. A bigger car, a fancy trip, a new phone-these aren’t emergencies.

- You’re selling because your friend told you to. Or because a TikTok video said to. Advice from strangers isn’t a strategy.

- You don’t have a plan to replace the money. Selling without a plan is like burning your bridge and then wondering how you’ll get back.

Final Thought: Cash Is a Tool, Not a Failure

Having cash isn’t weakness. It’s control. Selling stock to get cash isn’t failure-it’s strategy. The difference is in the why.

If you’re selling because you planned ahead, because you’ve thought through the taxes, the timing, and the impact on your portfolio? You’re doing it right.

If you’re selling because you’re scared, broke, or pressured? You’re at risk.

Stocks grow wealth. Cash protects it. The goal isn’t to never sell. It’s to sell with purpose.

Is it better to sell stocks or use a credit card when I need cash?

It depends. If you have high-interest credit card debt (over 15%), using it to cover expenses is expensive. Selling stocks might be cheaper, especially if you’re in a low tax bracket. But if you can pay off the card in full within a few months and your stocks are in a big gain, the card might be the lesser evil. Always compare the cost of capital: interest rate vs. capital gains tax.

Can I sell stocks and reinvest the money later without paying taxes?

No. In Australia, there’s no tax-free rollover for stocks like there is for homes. Selling triggers a capital gains event. You owe tax on the profit, even if you immediately buy back in. The only way to defer tax is through certain retirement accounts, which most retail investors don’t have access to. Don’t assume selling and rebuying avoids tax-it doesn’t.

What if my stock is down? Should I still sell if I need cash?

Yes-if you need the cash. Selling a losing stock gives you a tax benefit. You can use the loss to offset gains from other investments, lowering your overall tax bill. This is called tax-loss harvesting. It’s a smart move, not a failure. Don’t hold onto a losing stock just because you don’t want to admit a loss.

How much of my portfolio should I keep in cash?

Most financial advisors recommend keeping 3 to 6 months of living expenses in cash or cash equivalents-like high-interest savings accounts or term deposits. This isn’t money for growth. It’s your safety net. If you’re self-employed or have unstable income, aim for 6 to 12 months. Don’t keep this cash in stocks. It defeats the purpose.

Should I sell stocks to pay off debt?

Only if the debt interest rate is higher than your expected stock returns. For example, if you’re paying 18% on credit card debt and your portfolio averages 7% annually, paying off the debt is the smarter move. But don’t sell your best-performing stocks to pay off low-interest debt like a mortgage at 4%. That’s like selling your gold watch to buy a plastic one.

Next Steps: Build a Cash Buffer

Don’t wait for the next emergency. Start now. Set up an automatic transfer-$200 a month-from your paycheck into a separate savings account. Don’t touch it. Not for emergencies. Not for fun. Just let it grow.

After six months, you’ll have $1,200. After a year, $2,400. That’s enough to cover a flat tire, a vet bill, or a broken phone. No stocks needed.

When you have that buffer, selling stock becomes a choice-not a crisis.