PPF vs FD Calculator

Compare tax-adjusted returns for Public Provident Fund (PPF) and Fixed Deposit (FD) investments based on your inputs. PPF offers 7.1% tax-free interest, while FDs are taxable at your income tax rate.

Public Provident Fund (PPF)

Fixed Deposit (FD)

Every year, thousands of Indian investors face the same question: should I put my money in a Public Provident Fund (PPF) or a Fixed Deposit (FD)? It’s not just about interest rates. It’s about safety, taxes, liquidity, and long-term goals. If you’re trying to decide between these two, you’re not alone. But most people get it wrong because they focus only on the percentage return. Let’s cut through the noise.

What is PPF, really?

PPF, or Public Provident Fund, is a government-backed long-term savings scheme launched in 1968. It’s not a bank product. It’s a sovereign guarantee - meaning your money is as safe as it gets in India. You can open a PPF account at any post office or authorized bank. The minimum deposit is ₹500 per year, and the maximum is ₹1.5 lakh. You can contribute monthly or in lump sums. The account lasts 15 years, but you can extend it in blocks of five years after that.

The interest rate changes every quarter, but it’s always set by the government. In 2025, the rate is 7.1% per year, compounded annually. That’s higher than most bank FDs right now. But here’s the real kicker: PPF interest is completely tax-free. You don’t pay tax when you earn it, when you withdraw it, or even when you deposit it. That’s called EEE status - Exempt, Exempt, Exempt. No other investment gives you this triple tax advantage.

What about Fixed Deposits?

A Fixed Deposit is what most people think of when they say “savings account with higher interest.” You give a bank a lump sum for a fixed period - 7 days to 10 years - and they pay you interest at a predetermined rate. FDs are offered by all major banks and NBFCs. Rates vary. As of late 2025, top banks offer between 6.5% and 7.2% for 5-year FDs, depending on the bank and your age (senior citizens get 0.5% extra).

But here’s the catch: FD interest is fully taxable. If you’re in the 30% tax bracket, and your FD earns ₹50,000 in interest, you pay ₹15,000 in tax. Banks deduct TDS if your interest crosses ₹40,000 a year (₹50,000 for seniors). You still have to declare it in your income tax return. There’s no tax exemption. No EEE. Just plain old taxable income.

Lock-in periods: freedom vs. discipline

PPF has a 15-year lock-in. That sounds strict, but it’s designed to force long-term thinking. You can’t withdraw the full amount before 15 years. But after 7 years, you can take partial loans or withdrawals - up to 50% of the balance at the end of the 4th year. That’s useful for emergencies or big expenses like education or medical bills.

FDs are more flexible. You can break them anytime, but you’ll lose interest. Most banks charge a penalty of 0.5% to 1% if you break before maturity. Some banks offer flexible FDs where you can withdraw part of the amount without closing the whole account. But even then, you’re not getting the same tax benefits as PPF.

Think of PPF as a forced savings plan. FDs are more like a savings tool you can use whenever you want. Which one suits you depends on your discipline.

Who should pick PPF?

If you’re a salaried employee with a stable income and you’re thinking 10-15 years ahead, PPF is the smarter play. It’s perfect for:

- Building a retirement corpus without touching it

- Reducing your taxable income (PPF contributions qualify under Section 80C)

- Parents saving for their child’s future (you can open a PPF account for a minor)

- Anyone who wants guaranteed, tax-free returns

PPF isn’t for people who need quick access to cash. If you’re the type who might panic and withdraw during a market dip, PPF’s lock-in protects you from yourself.

Who should stick with FD?

FDs shine in three situations:

- You need liquidity in 1-5 years - say, for a car, wedding, or down payment

- You’ve maxed out your ₹1.5 lakh Section 80C limit with other investments like ELSS or insurance

- You’re a senior citizen looking for regular monthly income (some banks offer monthly interest payouts)

FDs are also better if you’re risk-averse but don’t want to wait 15 years. You can ladder your FDs - open multiple accounts with different maturity dates - to balance access and returns.

Real numbers: PPF vs FD over 15 years

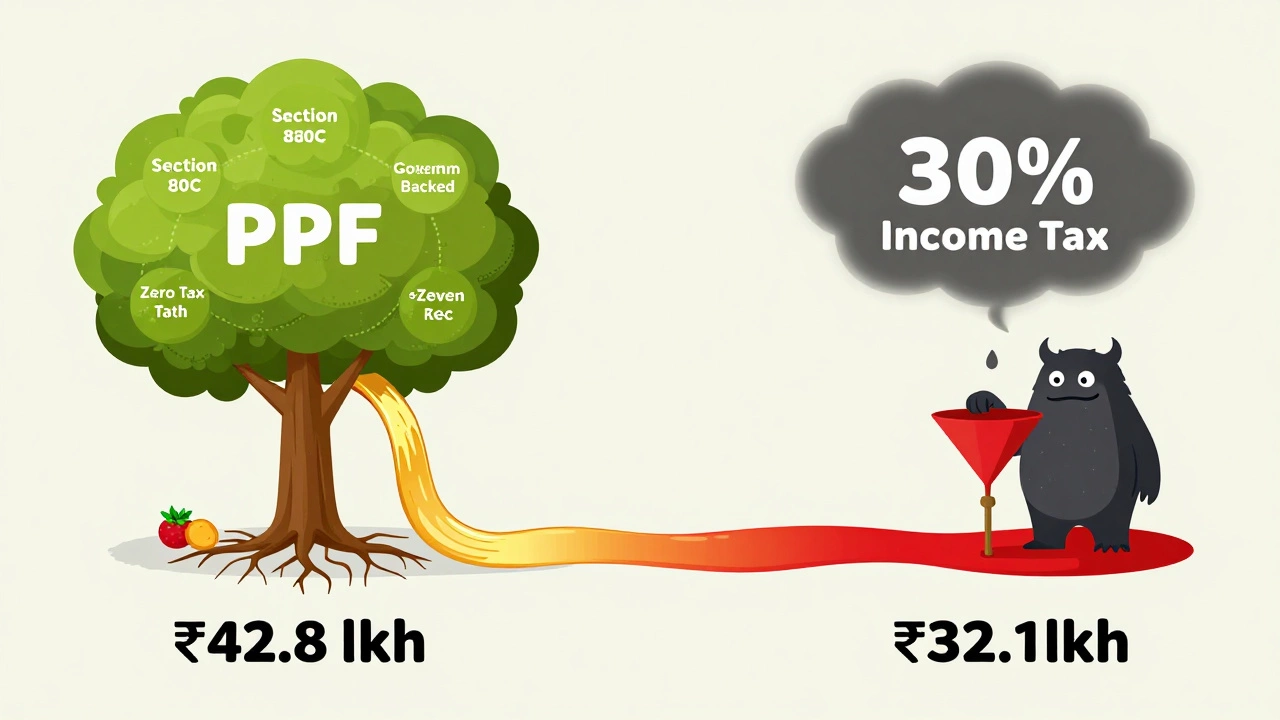

Let’s say you invest ₹1.5 lakh every year for 15 years.

PPF at 7.1%: Total investment = ₹22.5 lakh. Final amount = ₹42.8 lakh. All tax-free.

FD at 7% (with 30% tax on interest): Total investment = ₹22.5 lakh. Final amount = ₹32.1 lakh. But wait - you paid ₹7.3 lakh in taxes over 15 years on the interest earned.

That’s a difference of over ₹10 lakh - and that’s before considering inflation. PPF wins hands down on net post-tax returns.

What about inflation?

Both PPF and FD returns are fixed. Neither beats inflation consistently. The real return - after inflation - for both is around 3-4% in today’s economy. But PPF’s tax advantage makes its real return higher. You’re not losing 30% of your interest to taxes like you are with FDs.

That’s why PPF is still the best option for long-term wealth building in India, even with low inflation. It’s not about beating inflation - it’s about keeping more of what you earn.

Can you have both?

Yes. And you should.

Use PPF for your long-term goals: retirement, child’s education, or legacy. Use FDs for short-term goals: emergency fund, travel, or a new phone. Don’t force PPF to be your emergency fund. Don’t use FDs to build your retirement corpus. Each tool has its purpose.

Many people max out their ₹1.5 lakh Section 80C limit with PPF, then use FDs for the rest of their savings. That’s the smart move.

What’s changing in 2025?

PPF rates have been stable since 2022, but the government is considering extending the tenure to 20 years for new accounts to encourage longer savings. No changes yet. FD rates are more volatile. Private banks are offering higher rates to attract deposits, but the gap between public and private banks is narrowing. Senior citizen rates are still 0.5% higher across the board.

The biggest shift? More people are realizing that interest rate alone doesn’t matter. Tax efficiency does.

Final verdict

Is PPF better than FD? For long-term, tax-efficient, safe savings - yes. For short-term, flexible, predictable income - FD wins.

PPF gives you higher net returns, zero tax, and government backing. FD gives you flexibility and faster access. If you’re investing for goals 10+ years away, PPF is the only choice. If you’re saving for something in the next 3-5 years, FD is fine.

Don’t choose one over the other because someone told you it’s ‘better.’ Choose based on your timeline, your tax bracket, and your discipline. Most people pick FD because it’s easier to understand. But if you understand taxes, PPF is the obvious winner.

Can I open a PPF account for my child?

Yes. You can open a PPF account for a minor child. Only one account per child is allowed, and the total contribution limit across both your account and your child’s account is ₹1.5 lakh per year. The child becomes the owner when they turn 18. This is a popular way for parents to build tax-free wealth for their child’s education or marriage.

Can I withdraw money from PPF before 15 years?

Yes, but only partially and only after the 7th year. You can withdraw up to 50% of the balance at the end of the 4th year. You’re allowed only one withdrawal per year. Loans are also available between the 3rd and 6th year, up to 25% of the balance at the end of the 2nd year. Full withdrawal is only allowed after 15 years.

Is PPF safer than bank FD?

Both are safe, but in different ways. FDs are insured up to ₹5 lakh per bank per depositor under DICGC. PPF is backed by the Government of India - meaning there’s no cap on protection. Even if a bank fails, your FD up to ₹5 lakh is safe. But if the government defaults - which hasn’t happened in over 75 years - PPF could be at risk. Statistically, PPF is safer.

Can I have multiple PPF accounts?

No. One individual can have only one PPF account. Opening a second account is illegal and can lead to penalties. If you accidentally open two, you must close the second one. Interest earned on the second account will be forfeited, and you won’t get tax benefits on contributions.

Do FDs offer monthly interest payouts?

Yes. Many banks offer monthly, quarterly, or annual interest payout options on FDs. This is popular among retirees who need regular income. But remember - even if you choose monthly payouts, the interest is still fully taxable in the year it’s earned. You can’t avoid tax by choosing monthly payouts.