GST Refund Calculator

Enter your GST amounts to see if you're eligible for a refund. The ATO typically processes refunds within 28 days when documentation is complete.

Your Refund Result

Key Takeaways

- Only businesses registered for GST and with a valid GST claim can request a refund.

- File your claim through the ATO’s online portal or via your Business Activity Statement (BAS).

- Keep all tax invoices, credit notes and payment records for at least five years.

- The ATO typically processes refunds within 28 days, but delays can happen if documentation is incomplete.

- Use a checklist before submitting to avoid common pitfalls that stall payment.

What is a GST Claim?

Goods and Services Tax (GST) is a 10% broad‑based tax on most goods, services and other items sold or consumed in Australia. When your business pays more GST on purchases than it collects on sales, you become eligible for a GST refund. The refund is simply the excess GST you’ve already paid to the Australian Taxation Office (ATO).

Eligibility hinges on two things: you must be registered for GST, and you must have a net GST payable amount that is negative for the reporting period. The claim is lodged as part of your regular BAS filing.

Who Oversees the Process?

The Australian Taxation Office (ATO) administers GST and processes all refund claims. Most businesses interact with the ATO through the myGov portal, which links directly to the ATO’s online services. Accounting platforms such as Xero or MYOB can also submit BAS on your behalf, automatically populating the GST refund fields.

Step‑by‑Step Guide to Claiming Your GST Refund

- Confirm GST registration. Log into myGov and verify your ABN shows a ‘GST‑registered’ status. If you’re not registered, you’ll need to apply via the ATO’s Business Portal first.

- Gather supporting documents. Collect all tax invoices, credit notes, and receipts for purchases where GST was paid. Digital copies are acceptable as long as they’re legible and retain the original invoice number.

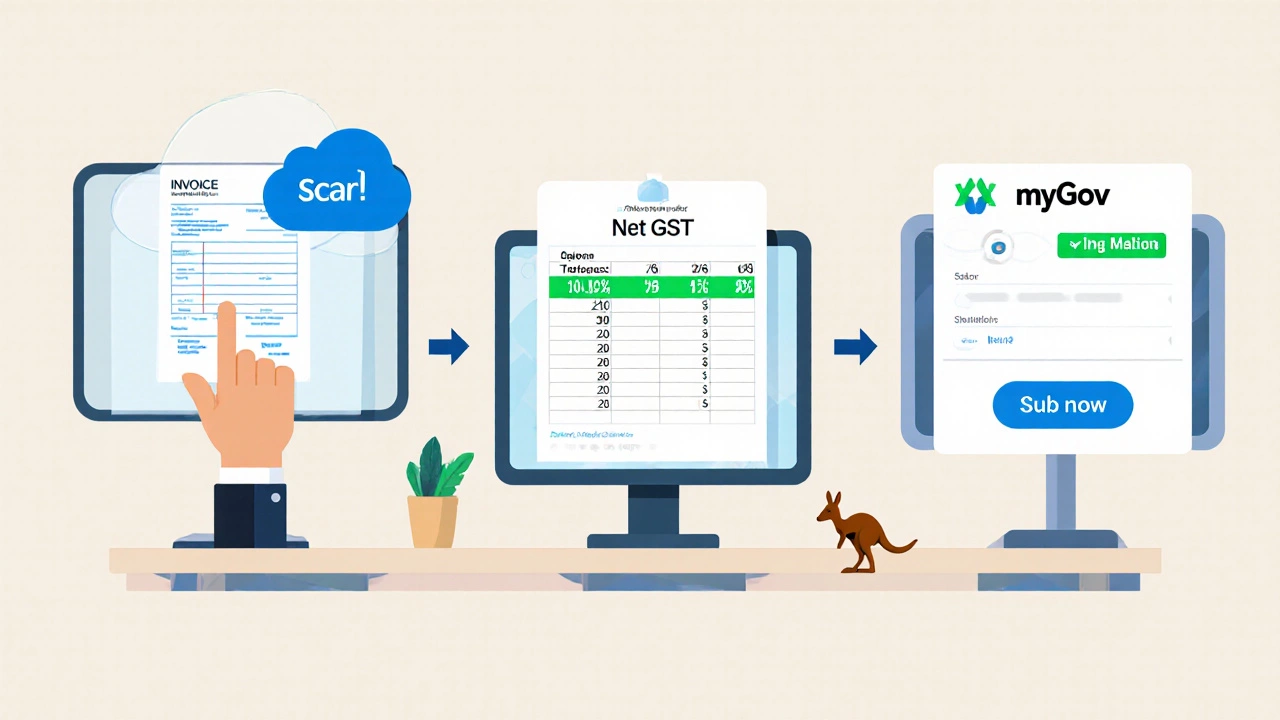

- Calculate net GST. Use your accounting software or a spreadsheet to total GST collected on sales and GST paid on purchases for the period (monthly, quarterly or annually, depending on your reporting cycle). The formula is:

Net GST = GST Collected - GST Paid

If the result is negative, you have a refund amount. - Prepare your Business Activity Statement (BAS). On the BAS, enter the negative GST amount in the “G2 - GST on purchases” field. The ATO’s online form will automatically calculate the refund figure.

- Submit the BAS. Log into the ATO portal via myGov, navigate to ‘ lodge BAS’, and follow the prompts. Review the summary page to ensure the refund amount appears correctly.

- Attach supporting records (if requested). The ATO may ask for copies of tax invoices after submission. Keep them ready; you can upload them directly through the portal’s “Provide documentation” link.

- Monitor the claim. After lodging, you’ll receive a confirmation email. Check the ‘Activity’ tab in myGov for status updates. Refunds are usually credited to the bank account linked to your ABN within 28 days.

- Reconcile the payment. Once the refund arrives, record it in your accounting software as a ‘GST refund receipt’. This ensures your cash flow statements stay accurate.

Common Pitfalls and How to Avoid Them

- Missing tax invoices. The ATO requires a valid tax invoice for every GST‑paid purchase. If an invoice is missing, request a replacement from the supplier or note the expense as an exception (allowed only in limited cases).

- Incorrect ABN on invoices. An invoice with a wrong ABN can be rejected. Verify the ABN on each supplier’s invoice before logging it.

- Late lodgment. Filing the BAS after the due date may trigger interest charges and delay the refund. Set calendar reminders a week before the deadline.

- Mixing personal and business expenses. Only GST on business‑related purchases is claimable. Separate personal spending in your records to avoid audit flags.

- Using the wrong BAS period. Ensure the period on your BAS matches the period for which you calculated the GST balance. A mismatch resets the claim.

Tools and Resources to Streamline Your Claim

Below is a quick comparison of three popular ways to lodge a GST refund claim.

| Method | Cost | Typical Processing Time | Key Advantage |

|---|---|---|---|

| ATO Online via myGov | Free | 28 days (standard) | Direct control, instant confirmation |

| Accounting software (e.g., Xero, MYOB) | Subscription fee (AU$30‑$70/month) | Same as ATO (software forwards automatically) | Auto‑populated fields, reduces data entry errors |

| Registered tax agent | AU$150‑$400 per BAS | Up to 45 days (agent processing) | Professional oversight, audit support |

Pre‑Submission Checklist

- ABN shows GST‑registered status.

- All tax invoices for the period are scanned and stored.

- Net GST calculation shows a negative balance.

- BAS fields (G1, G2, G11) correctly filled.

- Bank account details linked to your ABN are up to date.

- Reminder set for the next BAS due date.

Running through this checklist reduces the chance of a refund being delayed or rejected.

What Happens After the Refund Is Paid?

The ATO credits the amount to your nominated bank account. Record the credit as a GST refund receipt in your accounting ledger. This entry offsets the GST payable balance on your next BAS, effectively closing the loop for that period. Keep the confirmation email and bank statement for future audits.

FAQs

Can I claim a GST refund if I’m a sole trader?

Yes. Sole traders who are GST‑registered can lodge a BAS and claim any excess GST. The process is identical to companies, just use your individual ABN.

Do I need to lodge a BAS even if I have no sales?

If you’re still GST‑registered, you must submit a BAS each period, even with zero sales. Reporting a zero GST payable keeps your registration active.

How long can the ATO hold my refund?

Standard processing is 28 days. If the ATO requests additional documentation, the timeline extends until you provide what’s needed. Persistent delays may trigger a formal enquiry.

What if I miss the BAS due date?

Late lodgement incurs a 1% penalty on the GST amount due, plus interest. The refund can still be claimed, but expect the ATO to prioritize overdue accounts.

Can I claim GST on overseas purchases?

Only if the purchase was made through an Australian supplier who issued a valid tax invoice with GST. Import GST is generally claimed through the customs form, not the BAS.

Is there a minimum refund amount?

No. Even a small negative balance is payable, though the ATO may batch very low amounts with other refunds.

Do I need a tax agent to claim a refund?

Not mandatory. Many small businesses lodge directly via myGov. A tax agent can add expertise and reduce audit risk, but it adds cost.

How long must I keep GST records?

The ATO requires you to retain all GST records for at least five years from the date of the related transaction.