Home Loan Calculator

This calculator shows how your home loan term affects your monthly payment (EMI) and total interest paid over time. Based on your loan amount, interest rate, and loan term, it will calculate your EMI and show how many months you'll be paying.

When you take out a home loan, the bank doesn’t expect you to pay back the full amount all at once. Instead, you pay it back in small monthly chunks called EMI - Equated Monthly Installment. But how long does that last? How many months is EMI? The answer isn’t one number. It depends on your loan, your budget, and what you agree to with the lender.

EMI Isn’t a Set Time - It’s a Choice

Many people think EMI means a fixed period, like 12 months or 24 months. That’s not right. EMI is the payment you make each month. The length of time you pay it? That’s the loan tenure. And that’s what you pick when you apply for the loan.

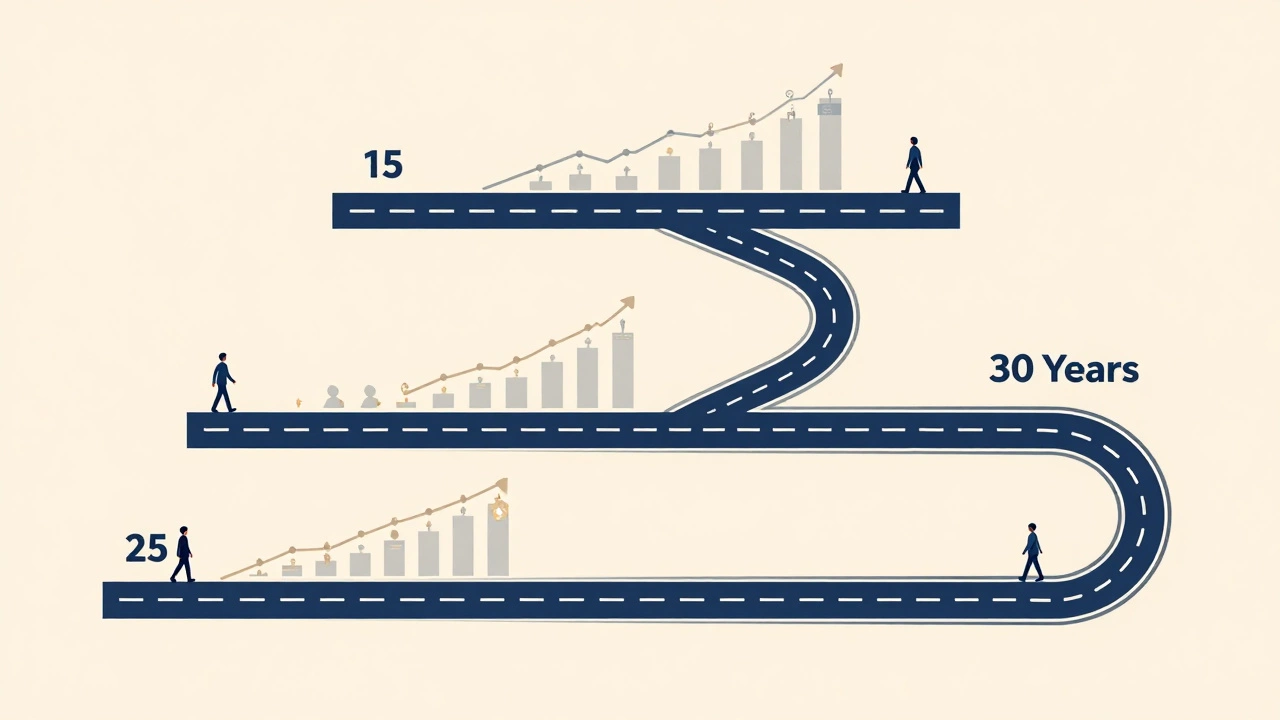

Most home loans in Australia run between 15 and 30 years. That’s 180 to 360 months. Some lenders let you go as short as 5 years (60 months), but that’s rare for home loans because the monthly payments become too high for most people. On the other end, 40-year loans exist in some countries, but not in Australia - the maximum is still 30 years.

So when someone asks, “How many months is EMI?” they’re really asking, “How long will I be paying my home loan?” And the answer is: whatever term you choose - usually 15, 20, 25, or 30 years.

Why Does Loan Term Matter?

Choosing your loan term isn’t just about how many months you pay. It affects your monthly budget, how much interest you pay over time, and even how fast you build equity in your home.

Take a $600,000 home loan at 6.5% interest. Here’s what happens with different terms:

| Loan Term (Years) | Months | Monthly EMI | Total Interest Paid |

|---|---|---|---|

| 15 | 180 | $5,236 | $342,480 |

| 20 | 240 | $4,446 | $467,040 |

| 25 | 300 | $3,975 | $592,500 |

| 30 | 360 | $3,715 | $737,400 |

See the pattern? The longer the term, the lower the monthly payment - but you end up paying way more in interest. A 30-year loan costs you almost $400,000 extra in interest compared to a 15-year loan. That’s like buying a second car just to cover fees.

On the flip side, a 15-year loan means you’re paying over $5,200 every month. That’s a lot for many families. So the real question isn’t “how many months is EMI?” - it’s “what can I afford, and how much extra am I willing to pay over time?”

What Determines Your Loan Term?

You don’t just pick a number out of thin air. Lenders look at a few things before approving your term:

- Your income - They want your EMI to be less than 30-35% of your take-home pay. If you earn $8,000 a month, they won’t let you take a $3,500 EMI unless you have strong savings or other assets.

- Your credit score - Higher scores get you better rates and more flexibility on term length.

- Loan-to-value ratio (LVR) - If you’re putting down less than 20%, you might be forced into a shorter term or need mortgage insurance.

- Age and retirement plans - Most lenders won’t let your loan run past your 70th birthday. So if you’re 55, you might only qualify for a 15-year term, even if you want 30.

One common mistake people make is stretching the loan to 30 years just to keep payments low. Then they get stuck. They can’t refinance later because their income didn’t grow, or they’re too close to retirement. You need to think long-term, not just monthly.

Can You Change the EMI Term Later?

Yes - but it’s not always easy. If you get a raise, inherit money, or want to pay off your loan faster, you can make extra payments. Most lenders let you pay extra without penalty. That reduces your principal faster and shortens your loan term without changing the paperwork.

For example, if you’re on a 30-year loan but pay an extra $500 every month, you could cut 8-10 years off your repayment. That saves you tens of thousands in interest.

On the other hand, if you lose your job or face an emergency, you might ask for a repayment holiday. Some lenders allow you to pause payments for 3-6 months, but interest keeps running. That doesn’t shorten your loan - it just delays it.

Reversing the term - going from 15 years to 30 - is harder. Lenders rarely allow it unless your financial situation has seriously worsened. And even then, you’ll need to reapply and prove you still qualify.

What Happens When EMI Ends?

When you make your final payment, you don’t just stop. The bank sends you paperwork - a discharge of mortgage - that says you own the property free and clear. You need to register this with your state’s land titles office. If you don’t, your name won’t be fully removed from the lender’s records, and it could cause problems if you ever sell.

Some people get emotional when they pay off their home loan. Others feel relief. But no matter how you feel, make sure you update your insurance, cancel any automatic payments tied to the loan, and keep copies of all final documents. This isn’t just paperwork - it’s your proof of ownership.

Common Myths About EMI Length

- Myth: Shorter term = better. Truth: Only if you can afford it. Forcing yourself into a 15-year loan when you can barely cover rent is a recipe for stress and default.

- Myth: Paying extra doesn’t help much. Truth: Even $100 extra a month on a 30-year loan can save you over $30,000 in interest and shave off 4 years.

- Myth: EMI includes insurance and taxes. Truth: In Australia, EMI usually covers only principal and interest. Property tax and home insurance are separate. Always check your loan statement.

- Myth: You can’t change your term after signing. Truth: You can’t change the contract, but you can pay more and effectively shorten the term. Many people do this without telling their lender.

How to Pick the Right EMI Term for You

Here’s a simple way to decide:

- Calculate what you can comfortably pay each month - leave room for emergencies.

- Use an online home loan calculator to see how much interest you’ll pay over 15, 20, 25, and 30 years.

- Ask yourself: Will I still be able to pay this in 10 years? What if interest rates rise?

- Consider your life goals. Planning to retire at 60? Don’t have a loan running until you’re 70.

- If you’re unsure, pick 20 or 25 years. It’s the sweet spot between affordability and savings.

There’s no magic number. But there is a smart choice - one that fits your life, not just your bank’s offer.

Final Thought: EMI Is a Tool, Not a Trap

EMI is designed to make homeownership possible. But it’s easy to let it become a life sentence. The number of months you pay doesn’t define your success. What matters is whether you’re building wealth - or just paying interest.

Choose your term wisely. Pay extra when you can. Review your loan every few years. And remember - the goal isn’t to pay EMI for 30 years. It’s to pay it off as soon as you can, so you can truly own your home.

Is EMI always monthly?

Yes, EMI stands for Equated Monthly Installment, so it’s always paid once a month. Some lenders offer biweekly payments, but that’s not standard in Australia. You’ll receive a statement each month showing your payment due.

Can I pay EMI in advance?

Yes, you can make lump-sum payments at any time. These go straight toward your principal, reducing your loan balance and shortening the term. Most lenders in Australia don’t charge fees for early repayments, but always check your loan contract.

What happens if I miss an EMI payment?

Missing one payment usually results in a late fee and a mark on your credit file. If you miss two or more, the lender may send a default notice. After three months of non-payment, they can start legal action to take your property. Always contact your lender if you’re struggling - many offer hardship arrangements.

Does EMI include property tax and insurance?

No. In Australia, EMI covers only the principal and interest on your loan. Property taxes (council rates) and home insurance are separate bills you pay directly. Some lenders offer escrow accounts for these, but it’s not common. Always budget for them separately.

How do I know if my EMI is too high?

If your EMI is more than 30% of your take-home pay, it’s considered high risk. If you’re struggling to cover groceries, utilities, or emergencies after paying EMI, it’s too high. Use the 50/30/20 rule: 50% needs, 30% wants, 20% savings/debt. Your EMI should fit in the 50% or less.