Gold Loan Credit Impact Calculator

This calculator shows how your gold loan repayment behavior affects your credit score in India. Remember: Only lenders who report to CIBIL will impact your score.

Your Estimated Credit Score Impact

Gold Loan Tip: Choose banks like SBI, HDFC, or ICICI that report to CIBIL. Smaller lenders often don't report.

If you're thinking about taking a gold loan in India, you're probably wondering: does gold loan affect credit score? The answer isn’t simple. It can help your credit score-or hurt it-depending on how you handle it.

Gold loans don’t automatically show up on your credit report

Most gold loans in India are issued by banks and NBFCs (Non-Banking Financial Companies), but not all of them report to credit bureaus like CIBIL, Equifax, or Experian. Only lenders who are registered with the credit information companies will report your loan activity. That means if your lender doesn’t report, your gold loan won’t appear on your credit report at all-good or bad.Major banks like SBI, HDFC, and ICICI do report gold loans to CIBIL. Smaller local lenders often don’t. So before you sign anything, ask: "Will this loan be reported to CIBIL?" If they hesitate or say "maybe," assume it won’t be reported.

How a gold loan can improve your credit score

If your lender reports to CIBIL and you repay on time, your gold loan can be a powerful tool to build or repair your credit. Here’s how:- Payment history matters most-making every EMI on time for 6-12 months shows lenders you’re reliable.

- Loan diversification-having a secured loan (like gold) alongside other credit types (credit cards, personal loans) improves your credit mix, which makes up 10% of your CIBIL score.

- Lower debt-to-income ratio-if you use the gold loan to pay off high-interest credit card debt, your overall credit utilization drops, which boosts your score.

One user in Pune took a ₹2 lakh gold loan in early 2024 to clear three credit cards with ₹2.4 lakh in balances. He paid the gold loan EMIs on time for 10 months. His CIBIL score jumped from 612 to 748. Why? Because his credit utilization fell from 92% to 18%, and his payment history improved.

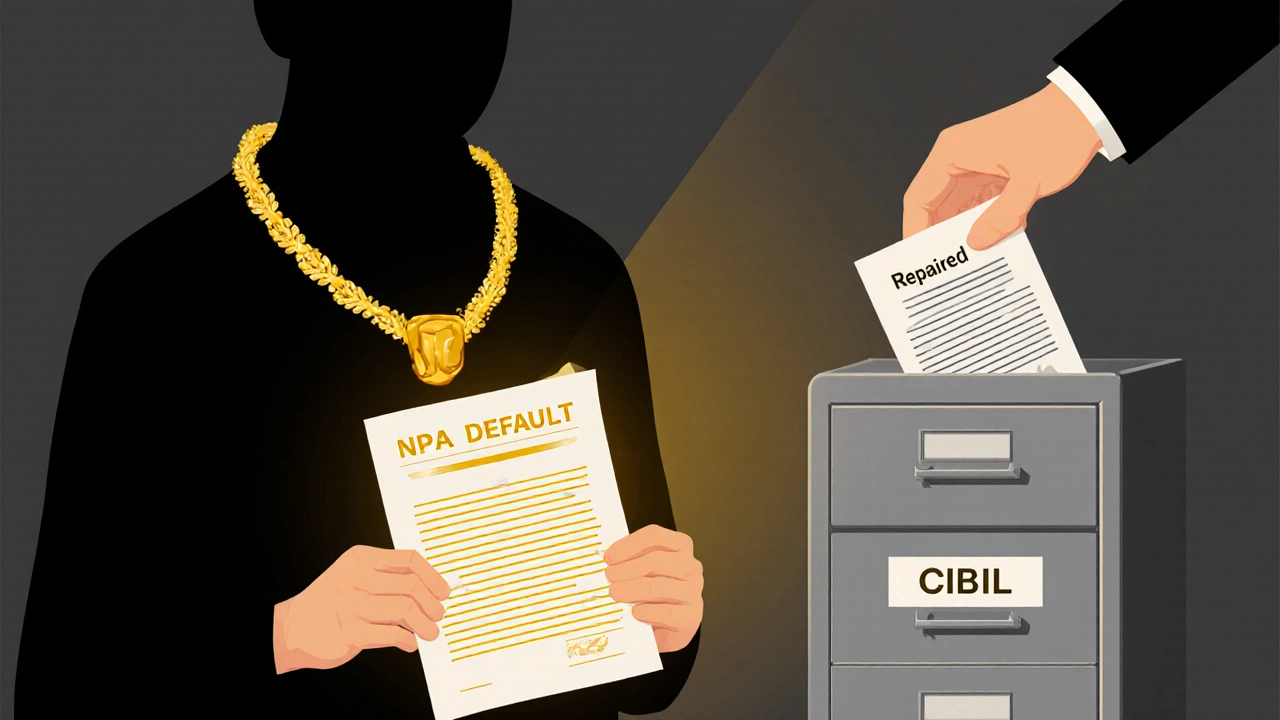

How a gold loan can hurt your credit score

The same loan that helps you can also wreck your score-if you miss payments. Here’s what happens:- Missed EMI-one late payment can drop your score by 50-100 points, especially if you’re new to credit.

- Default-if you don’t pay for 90+ days, the lender will classify it as a NPA (Non-Performing Asset). That stays on your report for 7 years.

- Gold auctioned-if your gold is seized and sold, the lender still reports the loss to CIBIL. Even if you pay the remaining balance later, the default mark remains.

There’s a myth that gold loans are "safe" because you have collateral. That’s not true for your credit score. The lender doesn’t care if you have gold-they care if you paid on time. One man in Hyderabad pledged his gold jewelry for ₹3 lakh in 2023. He missed three EMIs. His score dropped to 540. His gold was auctioned. He still owed ₹45,000. That unpaid balance is still on his report.

What lenders look for when you apply

Even if your gold loan doesn’t report to CIBIL, lenders still check your credit report before approving the loan. Why? Because they want to know if you’ve defaulted on other loans. If you have multiple unpaid personal loans or credit card dues, they might reject your application-even if you have 100 grams of gold.Most lenders use a cutoff score of 650-700 for gold loans. Below that, you’ll likely get higher interest rates or be asked for extra documentation. Some lenders, like Muthoot Finance and Manappuram, have started using alternative data (bank statements, mobile bill payments) to approve applicants with no credit history. But this is still rare.

How to use a gold loan to build credit (step by step)

If you want to use a gold loan to improve your credit score, here’s how to do it right:- Choose a lender that reports to CIBIL-ask directly. Banks are safer than small NBFCs.

- Borrow only what you can repay-your EMI should be less than 20% of your monthly income.

- Set up auto-debit-missed payments happen when you forget. Auto-pay removes that risk.

- Don’t take more than one gold loan at a time-multiple loans increase your debt burden and can trigger red flags.

- Keep your gold safe-if you lose the receipt or the gold is damaged, the lender may freeze your loan, which can trigger a default.

One woman in Chennai used a ₹1.5 lakh gold loan to start a small tailoring business. She repaid it in 14 months. Her CIBIL score went from 580 to 720. She now qualifies for a home loan at 8.5% interest-down from 12% before.

What happens if you can’t repay

If you’re struggling to pay, don’t ignore it. Contact your lender before you miss an EMI. Most banks offer one-time restructuring or a short payment holiday. But if you wait too long:- After 30 days: Late payment marked on your report.

- After 60 days:催收 calls, letters, and possible visits from recovery agents.

- After 90 days: Classified as default. Gold is auctioned. Remaining balance still owed.

- After 180 days: Legal action possible. Your name may be listed in SARFAESI records.

There’s no grace period for gold loans. Unlike personal loans, where some lenders allow 3-5 days of delay, gold loans are treated as secured debt with zero tolerance for delays. The lender’s priority is recovering the gold, not your credit score.

Gold loan vs. personal loan: which affects credit score more?

| Feature | Gold Loan | Personal Loan | |--------|-----------|----------------| | Collateral Required | Yes (gold) | No | | Interest Rate | 9%-14% | 11%-24% | | Credit Reporting | Only if lender reports | Almost always reports | | Approval Speed | 30 minutes-2 hours | 2-7 days | | Impact on Credit Score | Can help or hurt | Usually hurts if mismanaged | | Default Consequence | Gold auctioned | Wage garnishment, legal action |Personal loans hurt your score faster because they’re unsecured. But gold loans can be riskier if you’re not careful-because you lose something valuable, and the default still shows up on your report.

Myths about gold loans and credit scores

- Myth: "Gold loans don’t affect credit because you have collateral." Truth: Collateral protects the lender-not your credit score. Your payment behavior still matters.

- Myth: "If I repay early, my score jumps." Truth: Early repayment doesn’t boost your score. Consistent on-time payments do.

- Myth: "I can take multiple gold loans to build credit." Truth: Multiple loans increase your debt load and can lower your score.

Final advice: Use gold loans wisely

A gold loan isn’t a magic fix for bad credit. But if you use it right, it can be one of the fastest ways to rebuild your score in India. The key is: only borrow what you can repay on time, and only from lenders who report to CIBIL.If you’re unsure, check your current CIBIL score first. If it’s below 600, focus on paying down existing debts before taking a new loan. If it’s above 650, a gold loan could help you reach 750+-if you stay disciplined.

Remember: Your gold is collateral. Your credit score is your future. Don’t risk one for the other.

Does a gold loan affect my credit score in India?

Yes, but only if the lender reports to CIBIL or other credit bureaus. Major banks like SBI and HDFC do report, but many smaller lenders don’t. If you repay on time, it can improve your score. If you default, it will hurt your score badly.

Can I get a gold loan with no credit history?

Yes. Since gold loans are secured, lenders care more about the value of your gold than your credit history. But if you want the loan to help build your credit, choose a lender that reports to CIBIL. Some lenders like Muthoot and Manappuram now offer credit-building gold loans for first-time borrowers.

Will my gold loan show up on my CIBIL report immediately?

No. It usually takes 30-45 days after your first EMI payment for the loan to appear on your CIBIL report. The lender submits data monthly, so it won’t show up right away-even if you paid on time.

What happens if I miss one EMI on my gold loan?

One missed EMI can drop your CIBIL score by 50-100 points if the lender reports. You’ll also get a late fee and a notice. If you pay within 30 days, the late mark may be removed. After 90 days, it becomes a default and stays on your report for 7 years.

Can I get a home loan after repaying a gold loan?

Yes-if you repaid the gold loan on time and your CIBIL score is above 700. Many banks see a repaid gold loan as proof of responsible borrowing. It can actually improve your chances of getting a home loan at a lower interest rate.