Staking Risk Assessment Calculator

This tool helps you understand the potential risks of staking your cryptocurrency based on your platform choice and investment strategy.

Important: This is for educational purposes only. Staking involves financial risk. Do not invest more than you can afford to lose.

Risk Assessment Results

Key Risk Factors

When you hear about staking crypto, it sounds too good to be true: earn rewards just for holding your coins. But then the questions creep in-can I lose my crypto if I stake it? The answer isn’t a simple yes or no. It depends on what you’re staking, where you’re staking it, and how much you understand the risks. Most people think staking is like putting money in a savings account. It’s not. It’s more like lending your car to a stranger who might crash it-but you still own the car. Let’s cut through the noise.

Staking Isn’t Holding-It’s Locking Up Your Assets

Staking means locking your cryptocurrency in a wallet to help secure a blockchain network. In return, you earn rewards, usually in the same coin you’re staking. Ethereum, Solana, Cardano, and Polkadot all use staking. But unlike keeping crypto in a cold wallet, staking ties your coins to a validator node that participates in consensus. That’s where the risks start.

Here’s the truth: your coins don’t disappear. You still own them. But you don’t have full control over them while they’re staked. If you try to move them mid-staking, you’ll hit a lock-up period. On Ethereum, that’s 18-24 hours. On Solana, it’s 2-3 days. You can’t access them during that time. That’s not theft. That’s a technical restriction.

Can You Actually Lose Your Crypto? Yes-But Not Like You Think

You won’t wake up one day and find your staked ETH gone because a hacker broke in. That’s not how staking works. But there are real ways to lose value-or even your entire stake.

- Slashing: If you’re running your own validator node and it goes offline, double-signs a block, or acts maliciously, the network can slash part of your stake. On Ethereum, slashing can remove up to 100% of your staked ETH if you’re the main culprit. Most users don’t run their own nodes, but if you use a staking pool and that pool gets slashed, your share gets hit too.

- Smart contract bugs: If you stake through a third-party app or DeFi protocol, a glitch in the code could freeze your funds. In 2023, a bug in a popular staking dApp on Polygon locked over $40 million in ETH for 11 days. Users got their money back, but only after a community vote and emergency patch.

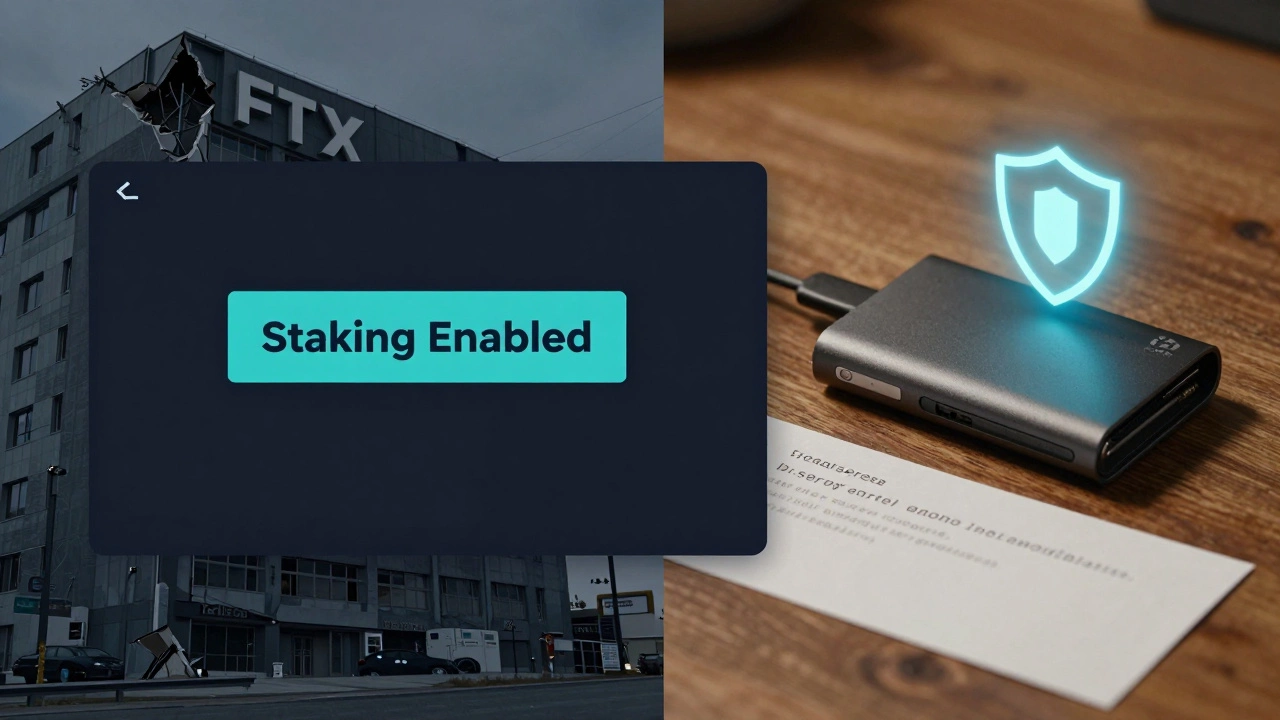

- Exchange insolvency: If you stake through a centralized exchange like Coinbase or Binance, you’re trusting them to hold your keys. If the exchange collapses (like FTX did), your staked coins are part of their balance sheet. You become an unsecured creditor. There’s no guarantee you’ll get them back.

- Price crash: Your staked SOL might earn 7% APY. But if SOL drops 60% while you’re staked, you’ve lost money-even if you earned rewards. Staking doesn’t protect against market risk.

Staking on a Centralized Exchange vs. Self-Custody

Where you stake changes everything. Here’s how they compare:

| Factor | Centralized Exchange | Self-Custody (e.g., Ledger, MetaMask) |

|---|---|---|

| Control of keys | Exchange holds them | You hold them |

| Slashing risk | Low (they manage nodes) | High if you run your own validator |

| Smart contract risk | Low | High (you choose the protocol) |

| Exchange collapse risk | High | None |

| Rewards | Higher (e.g., 8-10% APY) | Lower (e.g., 4-6% APY) |

| Withdrawal speed | Instant | Days (lock-up periods) |

Most people pick exchanges because they’re easy. But if you care about long-term security, self-custody is the only real way to protect your assets. You’ll sacrifice some yield and convenience, but you won’t be at the mercy of a company’s bankruptcy filing.

What Happens If the Network Goes Down?

Blockchain networks are designed to be resilient. But they’re not invincible. In April 2024, a major Solana outage lasted 18 hours. Validators couldn’t process transactions. Stakers didn’t earn rewards that day. Your coins stayed safe. But you lost income. That’s not theft. It’s downtime.

Networks with high decentralization-like Ethereum and Cosmos-are harder to break. Networks with fewer validators-like some newer chains-are more vulnerable. If a chain has fewer than 100 active validators, it’s easier for a single entity to control it. That’s a red flag.

How to Stake Safely

If you’re going to stake, here’s how to reduce risk:

- Only stake coins you’re willing to lock up for months. Don’t stake emergency funds.

- Avoid staking on exchanges unless you’re okay with the risk. Use reputable ones like Coinbase or Kraken-they’ve never collapsed.

- If you’re self-staking, use a hardware wallet like Ledger or Trezor. Never stake from a software wallet on your phone.

- Don’t stake on unknown DeFi protocols. Stick to well-audited ones like Lido, Rocket Pool, or Ankr.

- Check the validator count for the network. If it’s under 500, dig deeper.

- Never stake more than 10% of your total crypto holdings in one chain.

What About Rewards? Are They Guaranteed?

No. Rewards are not guaranteed. They’re estimated based on network activity. If fewer people stake, rewards go up. If everyone jumps in, rewards go down. Ethereum’s staking yield dropped from 12% in 2022 to 4.2% in early 2026 because over 40% of all ETH is now staked.

Also, rewards are paid in the same coin you stake. If that coin’s price falls, your rewards are worth less. You’re not earning dollars-you’re earning volatile assets.

What If You Get Hacked?

If someone steals your private key, they can access your staked coins-even if they’re locked. That’s why cold storage matters. If you use a hardware wallet and keep your recovery phrase offline, you’re protected. If you store your seed phrase in a cloud note or send it to a friend, you’re asking for trouble.

There’s no insurance for staking losses. Unlike banks, blockchains don’t have FDIC protection. If you lose your coins, you lose them.

Bottom Line: You Won’t Lose Your Crypto-But You Can Lose Value

You won’t wake up to find your staked Bitcoin gone. But you can lose money through slashing, exchange failure, price crashes, or poor protocol choices. Staking isn’t risk-free. It’s a trade-off: higher yields for less control.

If you’re new, start small. Stake 0.1 ETH on a reputable platform. Learn how it works. Watch how long withdrawals take. See how rewards change. Then decide if it’s worth it.

Staking is a powerful tool. But it’s not a magic money printer. Treat it like any investment-with eyes wide open.

Can I lose my crypto if I stake it on a reputable exchange like Coinbase?

You won’t lose your coins to hacking or slashing because Coinbase manages the staking infrastructure. But if Coinbase goes bankrupt or gets seized by regulators, your staked assets become part of their bankruptcy estate. You’d be an unsecured creditor. That’s why self-custody is safer long-term.

What happens if I stake on a DeFi protocol and it gets hacked?

If the smart contract has a vulnerability, hackers can drain funds. In 2023, over $200 million was lost across staking protocols due to code exploits. Only use protocols with multiple audits from firms like CertiK or Trail of Bits. Never stake more than you can afford to lose.

Is staking safer than holding crypto in a wallet?

It depends. Holding crypto in a cold wallet is the safest option-no exposure to slashing, exchange risk, or smart contract bugs. Staking adds yield but introduces new risks. If you’re not running your own validator, the risk is low-but still higher than just holding.

Can I unstake my crypto anytime?

No. Most networks have a lock-up period. Ethereum requires 18-24 hours to withdraw. Solana takes 2-3 days. Some chains like Cosmos have 21-day unbonding periods. You can’t access your coins during this time, even in a market crash.

Do I pay taxes on staking rewards?

Yes. In the U.S., the IRS treats staking rewards as taxable income when you receive them. You’ll owe ordinary income tax on the dollar value at the time you get them. If you later sell them, you may owe capital gains tax too. Keep detailed records.

If you’re serious about staking, treat it like a job-not a side hustle. Research the network. Understand the risks. Start small. And never assume your coins are safe just because you’re earning rewards.