NRI Mutual Fund Tax Calculator

Calculate Your Tax Liability

Estimate taxes on your mutual fund investments based on current NRI rules

Tax Estimate

If you're an NRI living abroad and thinking about investing in India, mutual funds are one of the smartest, simplest ways to grow your money. But not all funds are created equal for someone living outside India. The rules, tax treatment, and even how you invest change based on your residency status. So which mutual fund is best for NRI in India? The answer isn’t one single fund-it’s about matching your goals, risk level, and tax situation with the right type of fund.

Why NRIs Need Special Mutual Fund Options

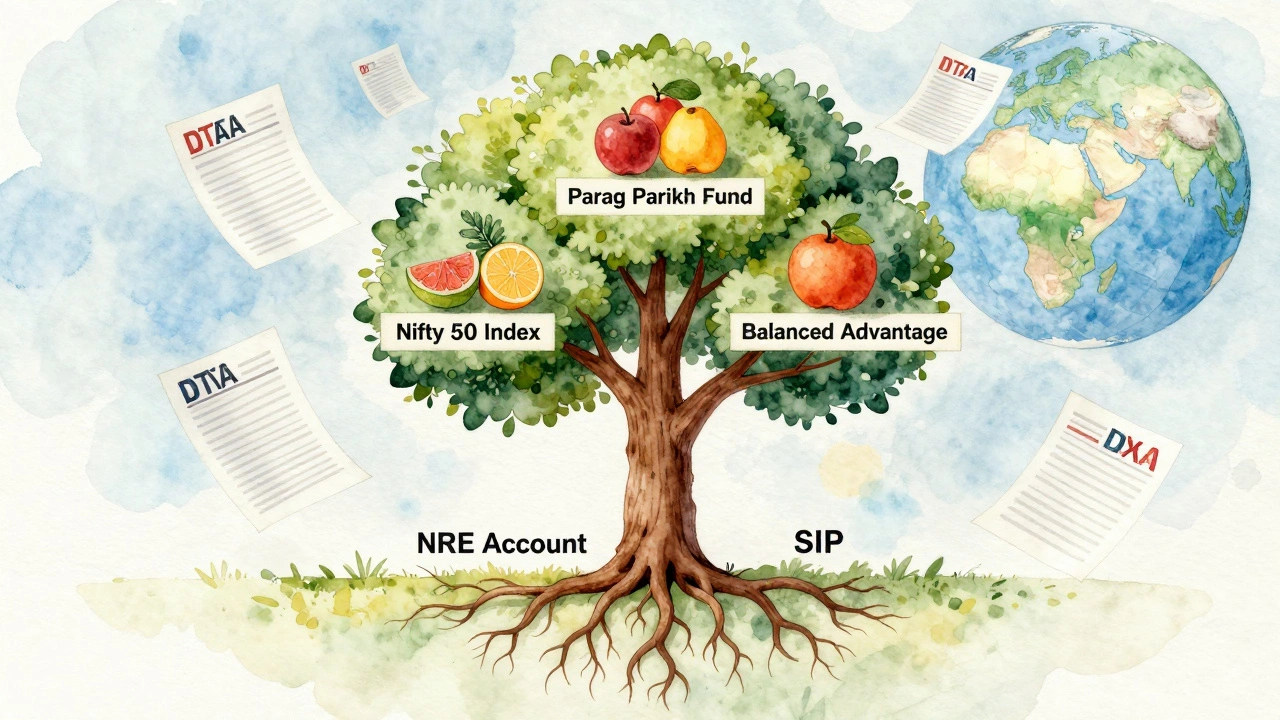

NRIs can invest in Indian mutual funds, but they can’t use regular savings accounts. You need to open an NRE (Non-Resident External) or NRO (Non-Resident Ordinary) account first. These accounts handle your foreign currency differently. NRE accounts let you repatriate money freely, while NRO accounts have limits on how much you can send abroad. Most NRIs use NRE accounts for long-term investments because they offer tax-free interest and full repatriation.

Also, mutual funds for NRIs are taxed differently than for residents. Capital gains are taxed based on how long you hold the fund and whether it’s equity or debt. If you’re in a country with a Double Taxation Avoidance Agreement (DTAA) with India, you might get tax credits back home. That’s why picking the right fund isn’t just about returns-it’s about how taxes work across borders.

Top Mutual Fund Types for NRIs in 2026

There are four main types of mutual funds that work best for NRIs:

- Equity Funds - Best for long-term growth (5+ years). These invest in Indian stocks and have historically returned 12-15% annually over the last decade.

- Hybrid Funds - Mix of stocks and bonds. Good if you want some stability without giving up growth.

- Debt Funds - Lower risk, but returns are lower (6-8%). Best for short-term goals like saving for a property down payment.

- Index Funds - Track the Nifty 50 or Sensex. Low fees, steady returns, and simple to understand.

Most NRIs start with equity or index funds because inflation in India is around 5-6% annually. If your money isn’t growing faster than that, you’re losing buying power over time.

Best Mutual Funds for NRIs in 2026

Here are five funds that consistently perform well for NRIs, based on 5-year returns, low expense ratios, and ease of investment:

| Fund Name | Type | 5-Year CAGR | Expense Ratio | Best For |

|---|---|---|---|---|

| Parag Parikh Flexi Cap Fund | Flexi Cap | 15.2% | 0.72% | Long-term growth, low volatility |

| Nippon India Index Fund - Nifty 50 | Index | 14.8% | 0.20% | Low-cost, market-matching returns |

| HDFC Balanced Advantage Fund | Hybrid | 13.5% | 0.85% | Market timing protection |

| Axis Bluechip Fund | Large Cap | 14.1% | 0.68% | Stable blue-chip companies |

| SBI Small Cap Fund | Small Cap | 18.3% | 0.89% | High growth, high risk |

The Parag Parikh Flexi Cap Fund stands out because it avoids overvalued stocks and focuses on quality businesses. It’s not flashy, but it’s reliable. The Nippon India Nifty 50 Index Fund is the cheapest option-just 0.20% fees-and gives you exposure to India’s top 50 companies. If you’re new to investing, this is the safest starting point.

Tax Rules NRIs Must Know

Taxes on mutual funds for NRIs are different from residents. Here’s what you need to remember:

- Equity Funds: If held more than 1 year, long-term capital gains are taxed at 10% (above ₹1 lakh). Short-term gains (under 1 year) are taxed at 15%.

- Debt Funds: Long-term (over 3 years) gains are taxed at 20% with indexation. Short-term gains are taxed at your income tax slab rate.

- Dividend Distribution Tax (DDT): No longer applies. Dividends are now taxed in your hands at your slab rate.

- DTAA Benefits: If you live in the US, UK, Canada, or UAE, you may avoid double taxation. File Form 10F and a Tax Residency Certificate (TRC) with your fund house.

Many NRIs make the mistake of assuming Indian mutual funds are tax-free. They’re not. But with the right planning, you can reduce your tax burden significantly. For example, holding equity funds for over a year cuts your tax rate from 15% to 10% on gains above ₹1 lakh.

How to Invest as an NRI

Investing is easier than ever. Here’s how to get started:

- Open an NRE or NRO account with an Indian bank (like ICICI, HDFC, or Axis).

- Complete KYC online using your passport, visa, and proof of address abroad.

- Link your NRE/NRO account to a mutual fund platform (Groww, Zerodha Coin, or MFUIndia).

- Choose your fund and invest via SIP (Systematic Investment Plan) or lump sum.

- Update your address and contact details every 2 years to avoid account freezing.

Most platforms now support international payments via SWIFT. You can invest in USD, EUR, or GBP, and the platform converts it to INR automatically. SIPs are ideal because they smooth out market volatility and require as little as ₹500 per month.

Pitfalls to Avoid

NRIs often fall into these traps:

- Chasing high returns without checking risk: Small-cap funds can give 18% returns, but they can also drop 30% in a year. Don’t put all your money in one.

- Ignoring tax filings: Even if you’re not living in India, you must file Form 15G/15H if you want to avoid TDS on dividends.

- Not updating KYC: If your passport expires or your address changes, your investments get frozen.

- Using non-NRI accounts: You can’t use a regular Indian savings account. It’s against RBI rules and can lead to penalties.

Also, avoid funds that don’t allow NRI investments. Some small fund houses restrict foreign investors. Always check the fund’s offer document or website for "NRI Eligible" before investing.

What to Do Next

If you’re ready to start:

- Begin with the Nippon India Nifty 50 Index Fund if you want simplicity and low cost.

- Pair it with Parag Parikh Flexi Cap for higher growth potential.

- Set up a ₹2,000/month SIP in each.

- Rebalance your portfolio once a year.

Don’t wait for the "perfect time." Markets don’t wait. Starting now with a small amount beats waiting for a big sum later.

Frequently Asked Questions

Can NRIs invest in mutual funds in India?

Yes, NRIs can invest in Indian mutual funds using NRE or NRO accounts. They must complete KYC and comply with FEMA regulations. Most fund houses accept NRI investments, but you must select funds explicitly marked as NRI-friendly.

Are mutual fund returns tax-free for NRIs?

No, mutual fund returns are not tax-free for NRIs. Equity funds are taxed at 10% on long-term gains above ₹1 lakh, and debt funds are taxed at 20% with indexation after 3 years. Dividends are taxed at your income slab rate. However, DTAA agreements may reduce double taxation.

Can NRIs invest through SIPs?

Yes, NRIs can invest through SIPs. You can set up automatic monthly investments from your NRE or NRO account. SIPs are ideal for NRIs because they reduce timing risk and require minimal effort once set up.

Which is better: NRE or NRO account for mutual funds?

NRE accounts are better for long-term mutual fund investments because they allow full repatriation of both principal and gains without restrictions. NRO accounts have limits on how much you can send abroad and are subject to higher tax withholding. Use NRE for growth-oriented investments.

Do I need to file taxes in India as an NRI with mutual fund investments?

You only need to file an income tax return in India if your total Indian income exceeds ₹2.5 lakh in a financial year. Mutual fund capital gains count toward this. Even if you don’t file, TDS is deducted on dividends and short-term gains. Filing helps you claim refunds if too much tax was withheld.

Can I switch mutual funds as an NRI?

Yes, you can switch between funds within the same AMC (Asset Management Company) or use the Systematic Transfer Plan (STP) to move money from debt to equity funds. Switching triggers capital gains tax, so plan it carefully. Always check the fund’s exit load before switching.

Final Thoughts

The best mutual fund for an NRI isn’t about the highest past return. It’s about alignment-with your goals, your risk tolerance, and your tax situation. For most NRIs, a mix of an index fund and a flexi-cap fund offers the right balance of safety and growth. Start small, stay consistent, and keep your documentation updated. The Indian market isn’t going anywhere, and neither should your investment plan.