Savings Account Alternatives: Better Ways to Grow Your Money in India

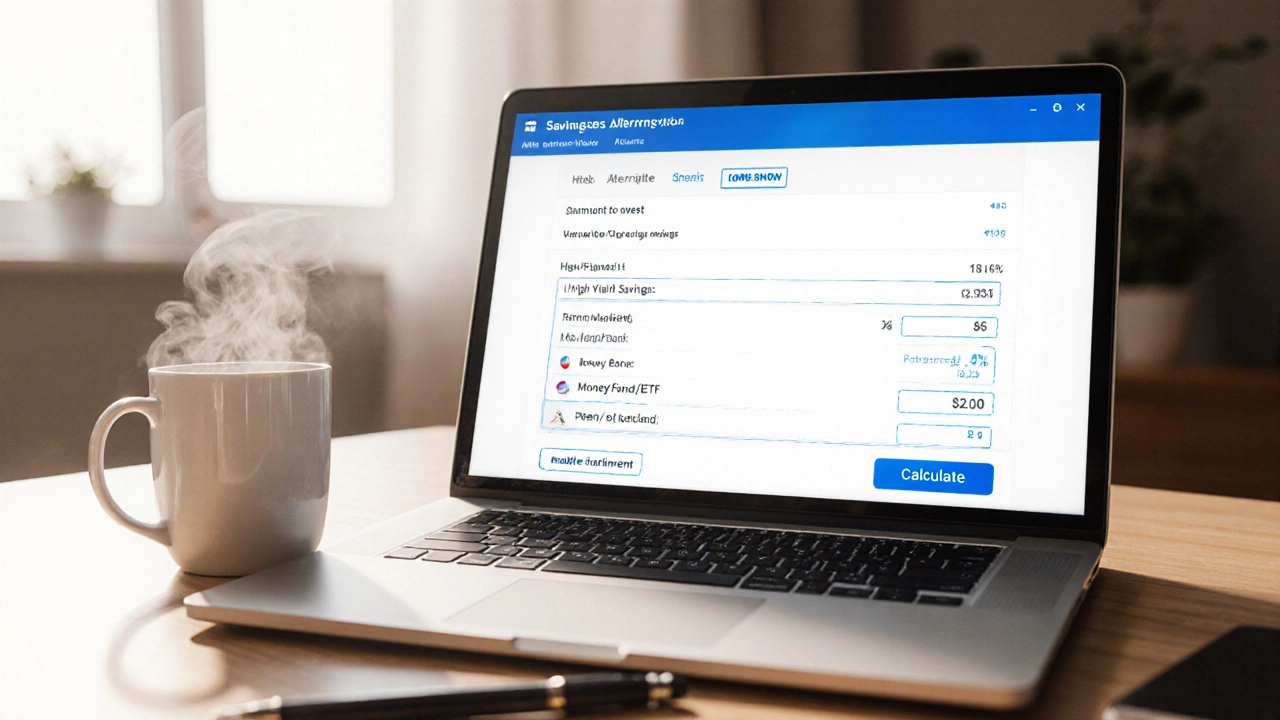

When you think of savings account alternatives, options that offer better returns than traditional bank savings accounts. Also known as high-yield investment options, these tools help your money work harder while keeping it safe. Most people stick with regular savings accounts because they’re familiar, but they’re missing out. The average savings account in India pays less than 4% interest—barely keeping up with inflation. Meanwhile, smarter choices like PPF, a government-backed long-term savings scheme with tax-free returns and fixed deposits, low-risk instruments offering higher interest than savings accounts can grow your money significantly faster.

It’s not just about interest rates. liquid funds, mutual funds that invest in short-term debt and offer near-cash liquidity let you access your money within a day while earning more than a savings account. And if you’re thinking about long-term growth, the 15-15-15 rule, a simple strategy to build ₹1 crore by investing ₹15,000 monthly for 15 years in equity mutual funds shows how compounding can turn small, consistent investments into serious wealth. These aren’t just theory—they’re real tools used by everyday Indians who want more from their money.

You don’t need to be rich or an expert to use these alternatives. Whether you’re saving for a car, a home, or retirement, there’s a better fit than a basic savings account. Some options lock your money for years, others let you withdraw anytime. Some give you tax breaks, others give you higher returns. The key is matching the tool to your goal. Below, you’ll find clear, no-fluff guides on exactly how these options work—what they cost, how safe they are, and who they’re best for. No jargon. No hype. Just what you need to decide where to put your money next.

Top Alternatives to a Savings Account: Higher Returns & Low Risk

Discover higher‑yield, low‑risk options that beat traditional savings accounts, from high‑yield savings to term deposits, bonds, ETFs, and more.

View more